King of precious metals. While Customs Dana Donald Trump As soon as they have just used, the financial markets are already responding, and it is the course of gold that has a jump forward to achieve a new historical higher higher higher. Yellow metal is indeed considered a refuge in the case of economic crisis or geopolitical tensions, and it seems that the trade war launched by the US President is one! Back on this new gold record.

- The course of gold reached a new historical summit for $ 3,534 per ounce, powered by Donald Trump’s customs taxes.

- Customs duties imposed by the US President on Chinese imports and other countries have reduced the global offer of gold and highlighted market pressure.

Gold has reached new history higher at $ 3,534 per ounce

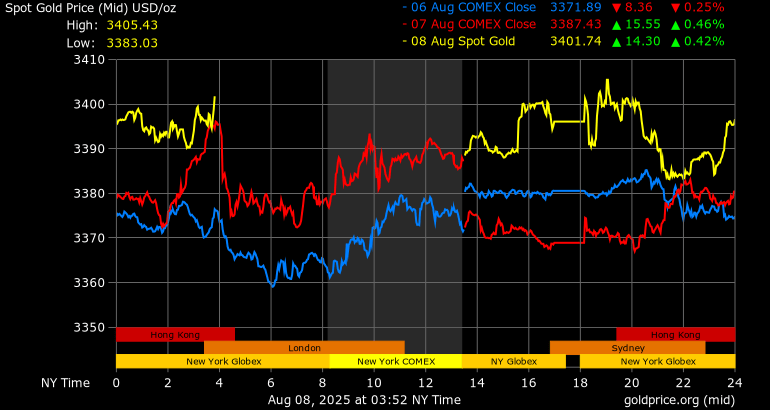

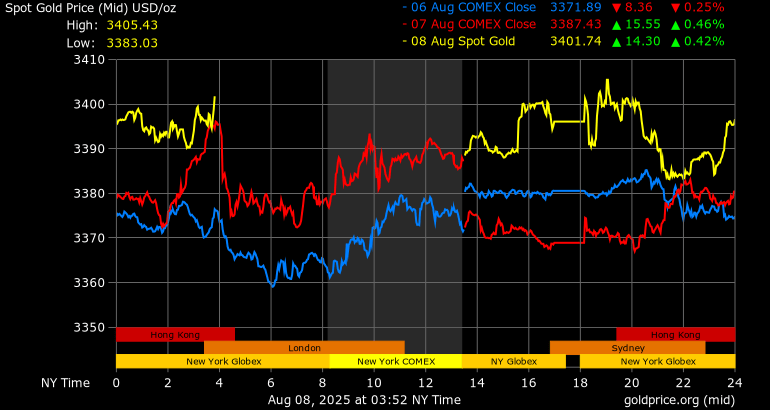

According to data from the COMEX contract market, the price of gold reached a historical record for 3 534.10 USD L’ -Y Once The August 8, 2025After a letter from the American customs and border protection 31. July thus reclassified 1 kg of gold lights in the category subject to rate 39 %Start price.

Yellow metal then dropped slightly to stabilize around 3,500 $ ounce but therefore broke his previous record 3,500 $ who dated from July 23rd. This new higher historical interferes with the context of trade between the United States and the rest of the world, and especially with China, which is the leading gold manufacturer in the world.

It is important to specify this record at $ 3,534.10 ComexAnd not a non -motion prize that remained around 3,394 USD/oz that day. The COMEX (Commodity Exchange Inc.) is the world’s main scholarship term contracts and possibilities of precious metalsSubsidiary CME group.

It sets out reference prices of gold through standardized contracts (often 100 Trojan ounces), which are mainly used for speculation or coverage – physical delivery remains rare. On the other hand Spot price It responds during the day for immediate delivery and reflects the actual value of physical gold.

President Trump actually imposed 145 % of customs duties For most Chinese imports, including gold that reduced the global offer and increases prices. He also imposed gold taxes from Switzerland, Brazil and India, which further emphasized the pressure on the market.

According to experts, the golden prices could continue to increase if the situation does not improve. “Gold Ingota tariffs will cause dislocation or problems when it comes to settling large banks, which was reflected in liquidity prices this morning, with prices that jump everywhere,” said Brian Lan, CEO of Central Goldsilver in Singapore.

Economic context soon favorable on the Fed side?

In addition to commercial voltage, the price of gold is also supported by expectations and Reducing interest rates American Federal Reserve (Fed). In fact, the Fed could be brought to soften its monetary policy to support the economy in the face of the negative impacts of customs taxes. However, the decline in interest rates is more attractive compared to other financial assets.

If gold is considered to be a refuge in the event of a crisis, the same applies to bitcoins that are often compared with yellow metal and which is even nicknamed digital gold. So we can legitimately think whether Danal Trump tax will increase the course of BTC and cryptocurrency. Answer in the coming weeks in a local newspaper!

(Tagstranslate) United States (US) (T) Financial Markets (T) or (Xau)