15:00

4

min at reading ▪

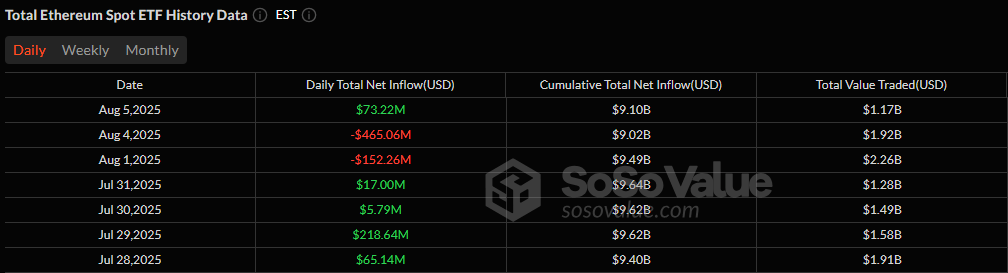

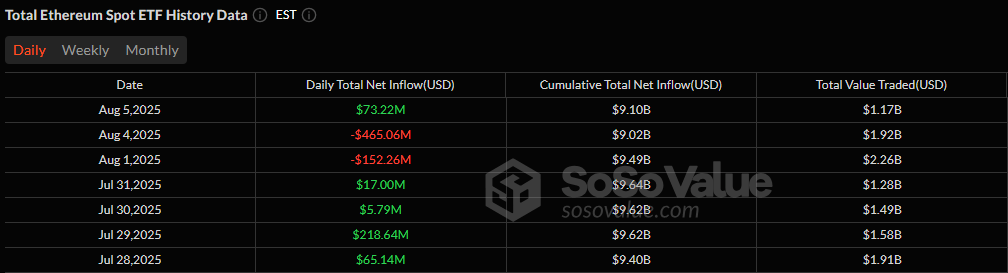

Recent capital flows on crypto ETF reveal contrast dynamics between two main crypts. While bitcoins are subject to massive release, Ethereum returns to the ground, carried by favorable regulatory signals and renewed institutional interest. This settlement emphasizes a change in the perception of the economic foundations of both assets at a key moment for the market.

In short

- Ethereum recorded $ 73 million in ETF, while Bitcoins have undergone $ 196 million in one day.

- These companies have 966 000 ETH and bet on stations as a stable yield lever.

- The US regulatory framework is cleaned for Ethereum and strengthens its attraction in the face of a legally exposed bitcoin.

ETF Crypto: Ethereum increases, bitcoin in free fall

Ethereum recorded around $ 73 million in net records of ETF 5. August 2025! Remarkable performance in an upset market. In parallel, Bitcoin ETF had its fourth consecutive trip with a total download of $ 196 million on that day.

This divergence of records and outputs between Bitcoins and Ethereum ETF reflects strategic relocation of investors. In fact, Ethereum perceives as a yield vector, especially because of its evoking features. Bitcoins, often limited to a reserve role, seem less attractive in the short term. The observed flows reflect a change in confidence towards ETH.

Stoking and Cash: Why does Ethereum seduce companies

The balance sheets with these companies depict a growing exhibition in Ethereum, which today is almost 966,000 ETH. About $ 3.5 billion. This development reflects a cash optimization strategy that is allowed by a betting that offers regular revenues around 3-4 %. As a result, the Ethereum environment becomes an alternative to traditional investments.

Companies accept the logic of inheritance towards assets and integrate its passive ability to return and its potential for recognition. This location represents a clear turning point with previous adoption waves, more speculative and writes Ethereum in a long -term financial strategy.

Crypto regulation: Ethereum calm, bitcoin concerns

In addition, clarification of dry confirmation that Ethereum betting is not considered a program of titles, is a turning point. This interpretation lightens the legal risk for issuers and ETFs exposed to assets. In addition, several legislative initiatives, such as the Brightness Act or the Act on the Brilliant Act, provide a framework for the development of stablecoins that are based on the Ethereum.

For comparison, bitcoins remain more vulnerable to regulatory interpretations in terms of lack of specific cases of use in financial infrastructure. In this context, the Ethereum seems to be better integrated into future regulatory standards. This strengthens his legitimacy in institutional actors.

In the face of massive Bitcoin selections, it excels as a new active refuge for crypto investors. ETH, supported by download, institutional interest and a clearer regulatory framework, ETH redraws the market balance. Dynamics that need to be carefully monitored to anticipate other trends in the crypto sector.

Maximize your Cointribne experience with our “Read to Earn” program! For each article you read, get points and approach exclusive rewards. Sign up now and start to accumulate benefits.

The world is evolving and adaptation is the best weapon that survives in this undulating universe. I am interested in everything about blockchain and its derivatives. To share my experience and promote an area that fascinates me, nothing better than writing informative and relaxed articles simultaneously.

Renunciation

The words and opinions expressed in this article are involved only by their author and should not be considered investment counseling. Do your own research before any investment decision.